Today, most companies seem to recognize that customer experience (CX) is an essential element of their business. They’ve taken first steps into building a CX foundation by inviting customers to participate in surveys and offer feedback. But companies could gain even more meaningful insight by optimizing their CX survey invitations.

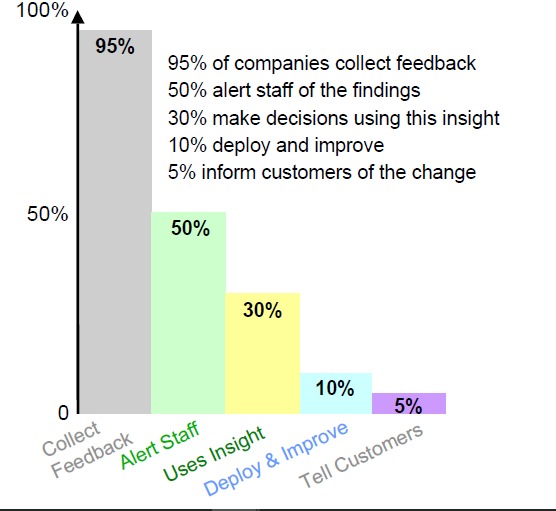

Consider this fact: research firm Gartner reported that 95 percent of companies they evaluated in one survey gathered feedback from customers. Still, Gartner found that many companies don’t make the best use of the insight they collect. Less than half shared CX feedback with customers and only 10% make changes based on customer feedback:

Image Source: Gartner

How can companies take more action based on the CX feedback they collect?

There are many answers. One clear way forward for companies is improving their CX survey invitations–so that they can gather more–and more meaningful–insight from customers.

Here are tips to create compelling CX survey invitations across three popular feedback gathering channels: IVR, email, and SMS.

IVR Survey Invitations

IVR has been a mainstay in the CX space for decades. Although email and SMS have grown in popularity, IVR has remained a cost-effective survey alternative that has strong appeal with certain customer types.

One of the best applications of IVR technology is conducting surveys immediately following an interaction with a contact center professional. In this scenario, companies should let customers know about the feedback opportunity at the start of the call, before they connect with an agent.

Companies can approach IVR survey invitations in two ways:

- Offer customers the option of taking a post-contact survey before the interaction starts. This approach may result in unbiased feedback, since customers have willingly opted in without knowing what their experience will be like. However, this approach can also cause customers who would leave feedback to miss the opportunity–or to have to find alternate channels to express their opinions.

- Automatically route customers to a survey after an interaction. This approach gives every customer an opportunity to leave feedback–even if they did not desire to participate in an survey from the start. The downside of this approach is that response rates may be lower overall, since it is easy to hang up after an interaction is complete.

Whichever approach they use, companies should make sure customers know that the post-contact survey will be brief. It can help to specify the number of questions, if that number is low.

Some of the most effective IVR surveys gather feedback using a standard closed ended question (or two) that can be answered using an easily understood scale. In addition, IVR surveys should feature at least one open-ended question, allowing customers to verbalize their feelings about the interaction.

Collecting immediate feedback after a contact is a widely-accepted best practice. In fact, Gartner research has revealed that feedback collected immediately after an event is 40% more accurate than feedback received one day later.

If companies don’t opt for immediate surveys, they should ensure to ask for feedback promptly. For a post-interaction call, companies should aim for outreach within 24 hours of the service event. An email or text-based survey can go out within 48 hours after the customer interaction.

Email Survey Invitations

In recent years, email has taken over as the dominant form of CX feedback gathering–due to ease of administration and low cost. But email response rates are typically lower than either IVR or SMS. The reason? Email CX survey invitations compete with many other emails in customers’ inboxes and lack an immediate and compelling call-to-action.

When crafting an email survey invite, companies should be mindful of email best practices:

- Use a clear subject line. It may be tempting to write a clever subject line that catches readers’ attention, but clarity is better. In fact, research from email automation provider AWeber found that emails with clear subject lines earned 541% more responses than those with a creative subject.

- Keep subject lines brief. Various email systems and devices can truncate subject lines–and prevent getting a clear message across. For best results, email subject lines should be 50 characters or less.

- Use a personal “from” address. Avoid using a corporate generic such as “customer service” as an email sender. Customers are apt to ignore these messages, but more likely to react to an email with a person’s name.

- Explain why they are receiving the email. Let customers know the purpose of the email right away. Tell customers how the feedback request ties to a recent interaction or purchase–and let them know how the feedback they provide will shape their experiences in the future.

- Set expectations on survey length and completion time. Make sure customers know how many questions the survey contains and give them an estimate of how long it will take them to complete.

- Make the survey link bold and clear. Don’t bury the survey link in text. Instead, call attention to it with a larger font size, bold color, or other call-to-action.

- Say “thank you.” An expression of gratitude makes customers feel appreciated — both for the time invested in the survey and their business relationship.

For post-interaction email surveys, aim to send a survey invitation as soon as possible after an interaction–ideally, within 24 hours or less. Alternatively, for a relationship email, set the send time according to customers’ time zones. Studies have shown the strongest email open rates occur for emails sent at 10:00 or 11:00 AM, 8:00 PM to midnight, 2:00 PM or 6:00 AM.

Mid-week email sends have higher response rates–with Tuesday ranked best, followed by Thursday, and Wednesday.

Image Source: CoSchedule

Image Source: CoSchedule

SMS Survey Invitations

As mobile devices and texting has earned widespread adoption, SMS has become an important feedback collection for brands. And SMS response rates are high- ranging from 15% to 35%. Still, SMS is more costly than other survey alternatives, so companies should carefully plan their SMS survey invitation strategy.

- Only request feedback from customers who have opted-in. Even if a customer provides a mobile number, brands should not automatically assume they have permission to send SMS messages. Companies can employ opt-in technologies or custom short codes to make it easy for customers to join SMS lists.

- Personalize interactions whenever possible. People are very attached to their mobile phones–and often carry them throughout the day. Respect that any company-sponsored text treads into personal territory–and make the survey invitation feel human and customer-focused.

- Time survey invitations carefully. As with other types of survey invitations, the best time to contact customers is shortly after a service event. If not sending messages right away, avoid evenings and early mornings. The best time to send SMS messages is during business hours–between 9:00 AM and 6:00 PM in customers’ time zones.

- Set clear expectations. Let customers know how long the survey should take–and the method for collecting information. Many mobile surveys keep the survey dialog within SMS using a back-and-forth model, but others may link to a web survey for more detailed feedback gathering.

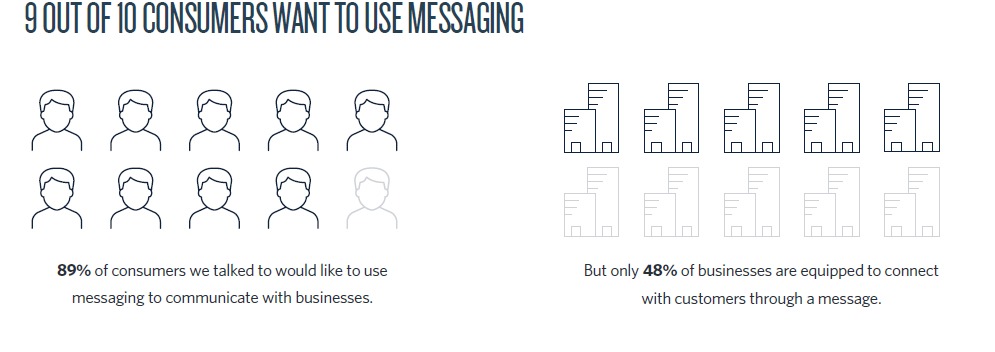

Although corporate uptake of SMS surveys has been somewhat slow, those that embrace text-based surveys can quickly win customer favor. A recent global study found that nine out of 10 consumers want to receive texts from companies–but less than half of brands have the infrastructure to meet this preference.

Image Source: Twilio

Effective CX Survey Invitations Secure More Meaningful Customer Feedback

Most CX practitioners know they need to secure more feedback–but are competing for customers’ time and attention. Crafting clear, attention-grabbing survey invitations can overcome this hurdle.

As more companies move towards a multi-channel feedback gathering approach, they need to devise specific CX survey invitation approaches for each channel. This approach takes effort, but can yield more meaningful customer insight that can shape critical business decisions.

Author: Connie Harrington

Connie is a content strategist and serves as managing editor of the eTouchPoint blog. Possessing 15+ years of international experience across five continents, her focus areas include: customer experience management, customer contact management, communications planning, content marketing, email marketing, and employee engagement. Previously, she held marketing and communications leadership positions at CGI, Mindwrap, and TEOCO. She earned a B.A., cum laude, from the College of William and Mary in Virginia.