Surveys are the most expedient ways to collect customer insight. But that expediency comes with a price.

Today’s customers are likely to receive a survey request every time they come in contact with a brand—and that can happen from a few to dozens of times each day.

No surprise: complex surveys can make customers reluctant to provide feedback. In fact, consumer research has revealed that between 2% to 4% of respondents abandon long surveys—each minute.

As “survey fatigue” escalates, companies need to make smart choices about their feedback gathering approaches.

The best way to maximize results? Set goals, determine what to measure, and choose one or more proven metrics as the foundation of a customer experience (CX) measurement program.

CX innovators often select from three trusted CX metrics approaches:

- Net Promoter Score (NPS®)

- Customer Satisfaction Score (CSAT)

- Customer Effort Score (CES)

Learn more about each below to pick the best fit for your CX program.

#1 Net Promoter Score (NPS)

Pioneered by Frederick F. Reichheld in 2003, NPS earned acclaim from the Harvard Business Review as “the one number you need to grow.” The reason for its appeal? NPS uses a simple, one-question format to gauge customer loyalty. As Reichheld explained:

By substituting a single question for the complex black box of the typical customer satisfaction survey, companies can actually put consumer survey results to use and focus employees on the task of stimulating growth.

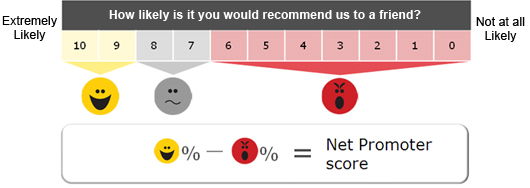

A NPS survey asks:

“How likely is it that you will recommend this product to a friend or colleague?”

Respondents provide ratings on an 11-point scale, from 0 (not likely) to 10 (extremely likely).

The NPS model groups respondents into three categories:

- 0 to 6 are “detractors” – Those who are negative about the brand and likely to harm its reputation.

- 7 to 8 are “passives” – Those who are unlikely to spread negative comments about a brand, but might switch loyalties if they have an alternate option.

- 9 to 10 are “promoters”- Those who appreciate a brand and are likely to share positive sentiments with others.

Image Source: Bain and Company

A brand’s Net Promoter Score equals the percentage of promoters minus the percentage of detractors:

NPS = % Promoters – % Detractors

A NPS score that is greater than zero (>0) is a good result. Reichheld has noted that the average American company has a score below 10, with high-performing organizations attaining scores of +50 to +80.

To understand the context behind customer ratings, NPS practitioners may include an unstructured, open-ended question in their surveys. This approach allows CX leaders and employees to access valuable feedback in customers’ own words.

#2 Customer Satisfaction Score (CSAT)

Another popular measurement approach, the Customer Satisfaction Score (CSAT), gauges customers’ overall satisfaction with a service or product. To measure CSAT, companies can use a single question in a follow-up survey, such as:

“How would you rate your overall satisfaction with the service or product you received?”

Image Source: Retently, 2016

The survey may present the customer with a numeric scale, with one (1) representing “Very Dissatisfied” to five (5) representing “Very Satisfied.” To derive a CSAT score, companies calculate the percentage of satisfied customers who provided a rating of four or five:

Number of Satisfied Customers (Score of 4 or 5) / Total Number of Survey Respondents X 100 = CSAT Score

A higher the percentage signals that customers are more satisfied with their experiences.

As with NPS, CX practitioners may include an open-ended question to collect free-form customer insights. And some CSAT surveys include multiple questions to gain more intelligence about customer perceptions.

CSAT works best as a gauge of interaction quality. However, it is less effective at measuring customers’ perceptions about their overall relationship with a company. A customer can give a high rating to a particular interaction, but not hold strong positive feelings a brand.

Still, tracking CSAT scores can give CX leaders valuable insights on performance of their front-line team. They can view the impacts of focused training or coaching initiatives in the short-term, or study CSAT trends over time for a long-term view of customer happiness with interactions. If managers notice declines in CSAT scores, they can take prompt steps to identify and address issues.

#3 Customer Effort Score (CES)

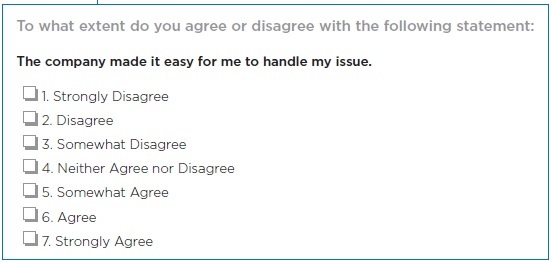

Developed by technology and consulting firm CEB, Customer Effort Score (CES), assesses how much effort a customers has to put forth during an interaction. Like NPS and CSAT, CES uses one question to collect customer insight:

Source: CEB, 2013

Source: CEB, 2013

CES operates under the premise that when brands make it easier for a company to do business with them, customers are more apt to be loyal. In addition, CES is a solid measure of the quality of a support program—which can include both self-service and person-to-person options.

A variant of CES, called the “NetEasy Score,” is the brainchild of analysts at British Telecom (BT). NetEasy uses a different question, but a similar seven-point scale:

Image Source: Contact Centre Helper

Similar to the NPS approach, a NetEasy score calculation subtracts low scores from high scores:

NetEasy = % Easy – % Difficult

Why does measuring customer effort matter? 2016 research from Ipsos Loyalty found that when customers perceive that they must put more effort into a resolving an issue than a company does, it can lead to negative outcomes. Notably, customers who expend higher levels of effort are 4x more likely to use a brand less or stop using it completely and 3x more likely to share poor perceptions on social media.

Measurement and Action Are Keys to CX Success

There is no single one-size-fits-all approach to set up a CX feedback gathering and measurement program. And brands do not need to devote themselves to a single metric as their one-and-only measure. Still, standardizing a measurement approach across all customer-facing teams is the best way to achieve a true “apples to apples” comparison of performance across the organization.

One of the advantages to selecting an industry-standard metric—whether NPS, CSAT, CES, or a combination—is that companies can benchmark their performance with peers and competitors.

Whatever the approach, keeping surveys brief, focused, and timely can help secure more responses from customers. Providing opportunities for open-ended feedback to allow customers to explain their scores is another best practice.

Ultimately, the selected measurement approach needs to map to company CX goals and customer climate. The keys to CX success are establishing a measurement program—and then taking action based on results.

*NPS is a trademark of Bain & Company, Satmetrics, and Fred Reichheld.

Author: Connie Harrington

Connie is a content strategist and serves as managing editor of the eTouchPoint blog. Possessing 15+ years of international experience across five continents, her focus areas include: customer experience management, customer contact management, communications planning, content marketing, email marketing, and employee engagement. Previously, she held marketing and communications leadership positions at CGI, Mindwrap, and TEOCO. She earned a B.A., cum laude, from the College of William and Mary in Virginia.